Services > i can often meet you on price

i can often meet you on price

we can offer a variety of terms and financing options to sellers who need to sell their homes quickly.

These terms can include:

Subject to: This type of financing allows buyer to make the payments directly to the lender. This can be a good option for sellers who are facing financial hardship and can't afford to make a down payment on a new home.

Creative financing: This type of financing is tailored to the specific needs of the seller and buyer. It can include options such as seller financing, a wrap, lease-to-own, or even a combination.

By offering a variety of terms and financing options, we can help sellers sell their homes quickly and get the money they need to move on to their next chapter.

the benefits of selling your home with terms, subto, or creative financing:

Speed: You can sell your home quickly and easily, without having to worry about listing it on the market or dealing with a real estate agent.

Flexibility: You can choose the terms and financing that work best for you.

There are no commissions or fees to pay, and you won't have to worry about making any repairs or staging your home.

What is i can often meet you on price?

Creative finance solutions is where we put aside traditional financing like the big banks and we dig deep to use time tested proven solutions that have worked across the country among many different types of sellers... Lets talk to see how we can help you.

Benefits of i can often meet you on price

The major benefit of selling to us is, we take care of all the fees.

Services > i can often meet you on price

i can often meet you on price

we can offer a variety of terms and financing options to sellers who need to sell their homes quickly.

These terms can include:

Subject to: This type of financing allows buyer to make the payments directly to the lender. This can be a good option for sellers who are facing financial hardship and can't afford to make a down payment on a new home.

Creative financing: This type of financing is tailored to the specific needs of the seller and buyer. It can include options such as seller financing, a wrap, lease-to-own, or even a combination.

By offering a variety of terms and financing options, we can help sellers sell their homes quickly and get the money they need to move on to their next chapter.

the benefits of selling your home with terms, subto, or creative financing:

Speed: You can sell your home quickly and easily, without having to worry about listing it on the market or dealing with a real estate agent.

Flexibility: You can choose the terms and financing that work best for you.

There are no commissions or fees to pay, and you won't have to worry about making any repairs or staging your home.

What is i can often meet you on price?

Creative finance solutions is where we put aside traditional financing like the big banks and we dig deep to use time tested proven solutions that have worked across the country among many different types of sellers... Lets talk to see how we can help you.

Benefits of i can often meet you on price

The major benefit of selling to us is, we take care of all the fees.

Properties with i can often meet you on price

The 3-Step Process For

i can often meet you on price

Step 1 Tell us about your property

Send us the address, whats going on with the property and pictures

Step 2 Let us review your info

After we have reviewed you information and done some research we can get together either on the Phone or on Zoom ...

We Bring i can often meet you on price Directly to You

Once we get detailed information from you and pictures we can structure a offer that makes sense for both of us...

3-Step Process For

i can often meet you on price

Step 1 Tell us about your property

Send us the address, whats going on with the property and pictures

Step 2 Let us review your info

After we have reviewed you information and done some research we can get together either on the Phone or on Zoom ...

We Bring i can often meet you on price Directly to You

Once we get detailed information from you and pictures we can structure a offer that makes sense for both of us...

i can often meet you on price FAQ's

Frequently Asked Questions About i can often meet you on price

Q: What does "subject to" mean in when selling?

A: "Subject to" in real estate when selling refers to transferring the property to a buyer while leaving the existing mortgage or loan in place. The buyer assumes responsibility for making payments on the existing loan without obtaining a new loan in their name.

Q: Is selling Real Estate subject to or Terms even legal?

A: Selling subject to an existing loan can be legal as long as all parties involved agree to the transaction and fulfill their obligations.

Q: How does the loan transfer process work?

A: When selling subject to, the buyer takes over the responsibility for making loan payments directly to the lender. The buyer assumes the loan under its existing terms, including the interest rate, remaining balance, and repayment schedule, and insurance responsibilities. The specific process can is generally a smooth and legally compliant transfer.

Q: What happens to my credit when selling subject to?

A: When selling subject to, your credit remains tied to the loan until it is paid off or refinanced. The buyer becomes the primary payer, and Your credit will be positively impacted based on their timely payment history. We ensure you have a clear agreement with us the buyer regarding their responsibility for making timely payments.

Q:Can the buyer refinance the loan later?

A: The ability of the buyer to refinance the loan in a Subject to transaction is not available. However the buyer can at anytime just pay off the loan.

Q: How do I protect myself when selling subject to?

A: To protect yourself when selling subject to, we provide you with a legally binding agreement that clearly outlines the responsibilities for making loan payments with a performance clause and maintaining the property and insurance. We also make sure the proper full-coverage insurance is kept on the car to protect you from any liability.

Q: Can I be released from the loan after selling subject to?

A: When selling subject to, you typically on the loan until it is paid off or refinanced.

Q: Why would I sell my house Subject to my loan or on Terms?

A: There could be several life situations why you might want to sell Subject to...

are you facing a foreclosure...

... possibly your over extended on bills, maybe it doesnt make sense to list with a Realtor or simply you just cant make the payment anymore... we can help you.

Q: How do I avoid getting scammed ?

Q: Do the Sniff test, check out your potential investor... Watch this video

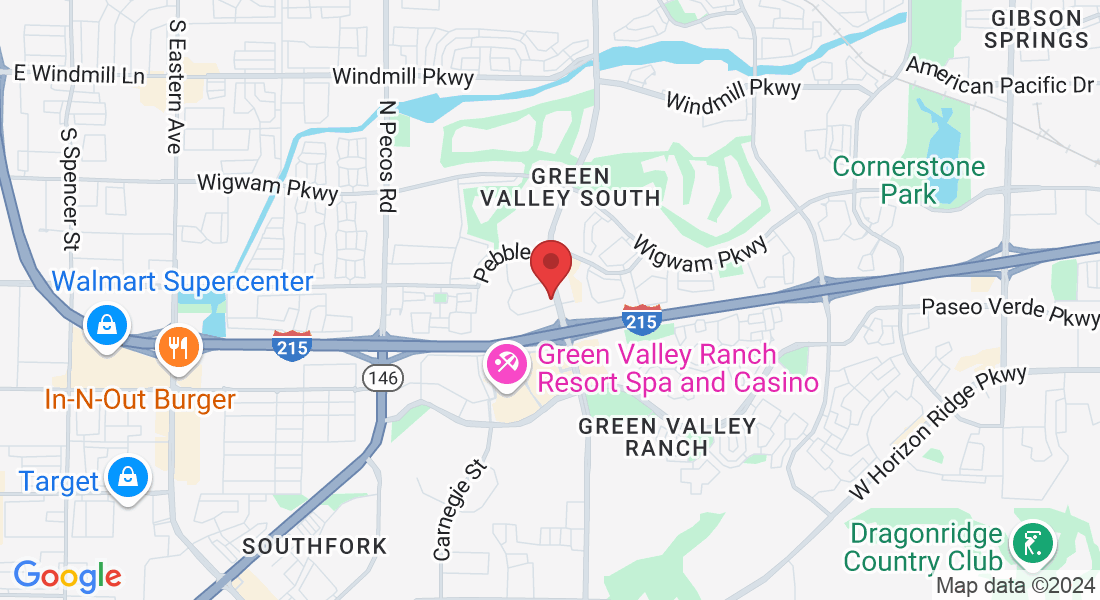

701 N Green Valley Pkwy

Henderson, NV 89074

702-659-7537

Monday - Friday: 9:00 AM - 5:00 PM

Saturday: 10:00 AM - 2:00 PM

Sunday: Closed

i can often meet you on price FAQ's

Frequently Asked Questions About i can often meet you on price

Q: What does "subject to" mean in when selling?

A: "Subject to" in real estate when selling refers to transferring the property to a buyer while leaving the existing mortgage or loan in place. The buyer assumes responsibility for making payments on the existing loan without obtaining a new loan in their name.

Q: How does the loan transfer process work?

When selling subject to, the buyer takes over the responsibility for making loan payments directly to the lender. The buyer assumes the loan under its existing terms, including the interest rate, remaining balance, and repayment schedule, and insurance responsibilities. The specific process can is generally a smooth and legally compliant transfer.

Q: Can the buyer refinance the loan later?

A: The ability of the buyer to refinance the loan in a Subject to transaction is not available. However the buyer can at anytime just pay off the loan.

Q: How do I protect myself when selling subject to?

A: To protect yourself when selling subject to, we provide you with a legally binding agreement that clearly outlines the responsibilities for making loan payments with a performance clause and maintaining the property and insurance. We also make sure the proper full-coverage insurance is kept on the car to protect you from any liability.

Contact Us

702-659-7537

701 N Green Valley Pkwy

Henderson, NV 89074

Service Hours

Monday - Friday: 9:00 AM - 5:00 PM

Saturday: 10:00 AM - 2:00 PM

Sunday: Closed

2026 | Brian buys Houses As Is | Sitemap